Julian Kwan

support@investaX.io

+65 9228 0994

InvestaX Launches World’s 1st Digital SPACs

- SINGAPORE - Wednesday, 10. March 2021

- AETOSWire

(BUSINESS WIRE)-- InvestaX, pioneers and creators of next generation technology driven investment products, announces the launch of the world’s first Digital SPACs, using smart contracts and blockchain technologies.

InvestaX is a Singapore-headquartered and licensed platform for Digital Securities Offerings (DSOs) of global private markets deals, including venture, private equity & real estate.

Digital SPACs are going to play an integral role in providing necessary capital to growing companies in new industries and give investors access to unique and leading technology companies creating the infrastructure for the digital era.

InvestaX CEO, Julian Kwan, said, “InvestaX and partners, offer Digital SPACs targeting cryptocurrency infrastructure, blockchain and DLT start-ups, games and e-sports, space, robotics, AI, and other future looking industries that are reshaping the 21st century.”

Soul Capital Founder Billy So has built a successful tech portfolio of startups, many in the cryptocurrency industry, and is lead sponsor of the world’s 1st Digital SPAC.

Atlas One is the North America distribution partner.

Sponsors will accept cash or cryptocurrencies as investment, opening up a greater universe of investors and product offerings than traditional SPACs.

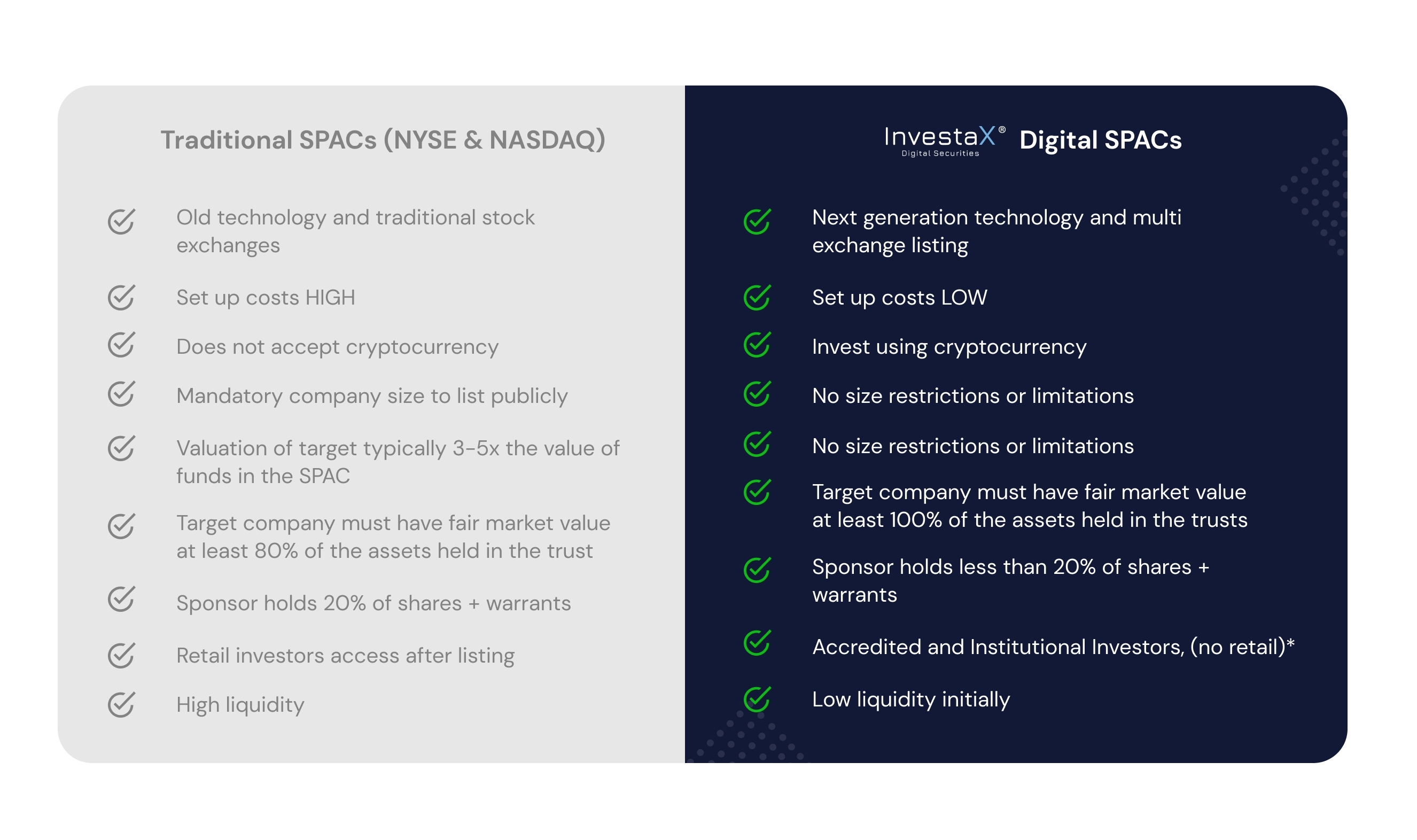

Digital SPACs will bring many similar elements of traditional SPACs, but offer a faster, lower cost, more flexible alternative, importantly bringing much needed capital to earlier stage start-ups in new industries, as well as greater transparency and better terms for investors.

Issuing a Digital SPAC using blockchain provides wider distribution channels for global investors who are prevented from, or prefer not to invest through traditional SPACs listed on USA stock exchanges. Digital SPACs will be distributed globally, not just domestically, opening up new markets and opportunities for sponsors and investors.

InvestaX will open source the smart contract code for the Digital SPAC, to bring greater openness, velocity, interoperability and global distribution. The average size of traditional SPACs in 2020 was approx. $350M USD making it challenging to find acquisition targets as the valuation range required is between $1-3BN USD. The first wave of Digital SPACs will target $10-50M USD, ensuring a much larger pool of potential acquisition targets and less competition for sponsors.

InvestaX provides key infrastructure to digitize real assets so you can use them to buy, sell, trade, borrow or lend instantly, across the world, 24x7.

Sign-up at www.investaX.io

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210309006112/en/